As a young advisor, I went through a formal training to develop young advisors. The goal was to learn how to understand a client’s needs and desires and

Read More

The fiduciary duty of an investment advisor is a cornerstone of the financial services industry, emphasizing the obligation to act in the best interests of

Read More

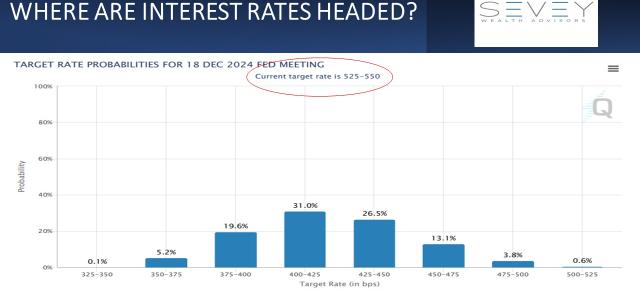

The Federal Reserve (the Fed) is expected to cut interest rates in 2024. This can have significant effects on both the stock and bond markets. Here's a general

Read More

The tax code, with all of its hundreds of pages of regulations, stipulations, and loopholes always leave something be learned. Not only is the U.S. Internal

Read More

As we approach the season of gratitude and gather around the table for Thanksgiving, the joy of preparing a feast becomes a cherished tradition. Much like the

Read More

The third quarter of 2023 saw a continuation of this year’s trend of investors steadily funneling into Money Market funds, which amassed inflows of $183.9B

Read More

Investors might finally be able to unfasten their seatbelts, as interest rates may have reached their cruising altitude.

During the September 2023 meeting

As advisors, we are often asked about rolling over your 401(k) to an IRA. This is a financial decision that should be made carefully, as there are situations

Read More

As you approach retirement, it's important to start thinking about how RMDs will affect your finances. And even if retirement is far in the future, it’s

Read More

On December 31, 2025, the 2018 Tax Cuts and Jobs Act (TCJA) is scheduled to expire. The expiration of these tax rules will add additional uncertainty to an

Read More

While the loss of a spouse if terribly upsetting, there are a number of action items the surviving spouse will need to address. Unfortunately, the IRS does not

Read More

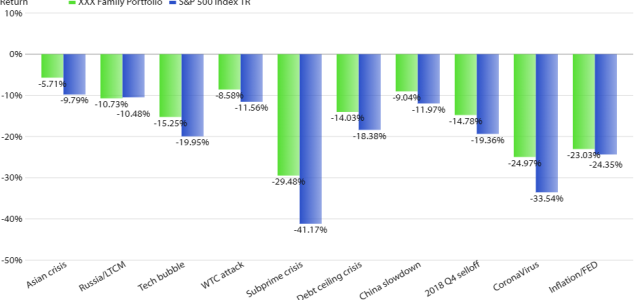

Downside protection is a crucial element in an investment portfolio, particularly for retirees, due to the unique financial circumstances they face. Retirees

Read More