Retirement planning is a critical aspect of financial security, requiring a strategic approach to ensure a stable and adequate income throughout one's

Read More

Smart investing doesn’t happen in a vacuum.

Current events matter, and this year, the 2024 Presidential Elections are taking center stage.

That’s rattling a

Read More

While divorce may be hard on your emotional well being, you should try to minimize the impact your retirement plans.

Read More

There's more to preparing for retirement than just saving. Here's what to consider.

Read More

While divorce may be hard on your emotional wellbeing, you shouldn’t let it impact your retirement plans.

Read More

As advisors, we are often asked about rolling over your 401(k) to an IRA. This is a financial decision that should be made carefully, as there are situations

Read More

As you approach retirement, it's important to start thinking about how RMDs will affect your finances. And even if retirement is far in the future, it’s

Read More

On December 31, 2025, the 2018 Tax Cuts and Jobs Act (TCJA) is scheduled to expire. The expiration of these tax rules will add additional uncertainty to an

Read More

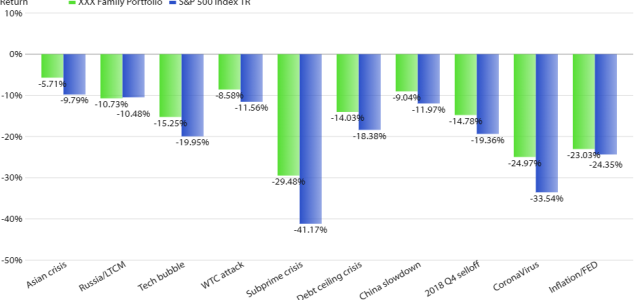

Downside protection is a crucial element in an investment portfolio, particularly for retirees, due to the unique financial circumstances they face. Retirees

Read More

How can higher earners increase their retirement savings TAX FREE? The Mega Backdoor Roth Strategy has gained significant attention as a powerful tool for high

Read More

Understanding when and how to claim Social Security benefits isn’t always straightforward, especially if you plan to continue working. While you can start

Read More

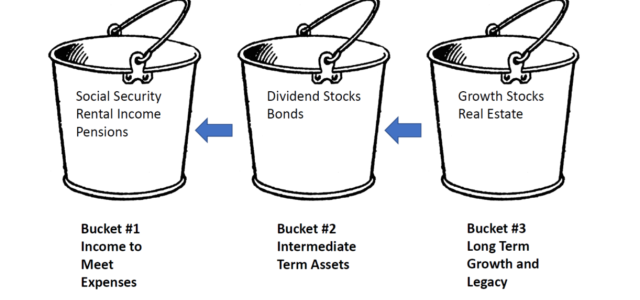

Unless you have enough money to live off just the interest of your portfolio, you will need to choose between a systematic withdrawal plan and utilizing

Read More