Why I Prefer Retirement Buckets vs a Systematic Withdrawal Plan

Unless you have enough money to live off just the interest of your portfolio, you will need to choose between a systematic withdrawal plan and utilizing retirement buckets to provide your retirement income. Here is why I prefer the retirement buckets strategy:

1. Psychological comfort: Retirement buckets provide a clear and simple structure, which can help retirees feel more in control of their finances. Knowing that they have separate buckets designated for different time horizons and goals can reduce anxiety about running out of money during retirement.

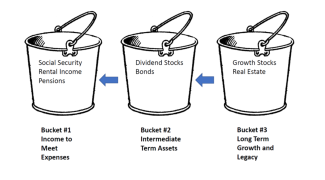

2. Risk management: By dividing your retirement savings into different buckets, each with a different time horizon, you can tailor your investment strategy for each bucket based on the appropriate risk level. This can help protect your short-term income needs from the volatility of long-term investments.

3. Improved asset allocation: Retirement buckets can lead to a more refined asset allocation strategy. For example, funds earmarked for immediate expenses can be kept in low-risk, liquid assets, while those for long-term goals can be invested in potentially higher-yielding but riskier assets.

4. Flexibility: The bucket strategy allows for greater flexibility in retirement planning. It can adapt to changing circumstances, such as market conditions, lifestyle changes, and unexpected expenses.

Ultimately, the choice between retirement buckets and systematic withdrawals depends on your personal preferences, risk tolerance, financial goals, and time commitment to managing your retirement income. Some retirees may even choose to combine elements of both strategies to strike a balance between simplicity and risk management. It's essential to carefully consider your unique financial situation and consult with a financial advisor to determine the most suitable approach for your retirement plan.