Understanding Volatility

If you could go back to December 31, 1999 and put every dollar in the market—knowing a brutal bear market was about to hit—would you do it? Most people say yes. Even buying at the peak, staying invested still paid off over time.

That’s the lesson of volatility: it feels awful in the moment, but it isn’t fatal if your plan is built for it. You would have lived through the dot-com bust, the Global Financial Crisis, the pandemic shock, and 2022’s slump—and still been rewarded for discipline. We believe clarity beats noise: volatility is the market updating prices to new information.

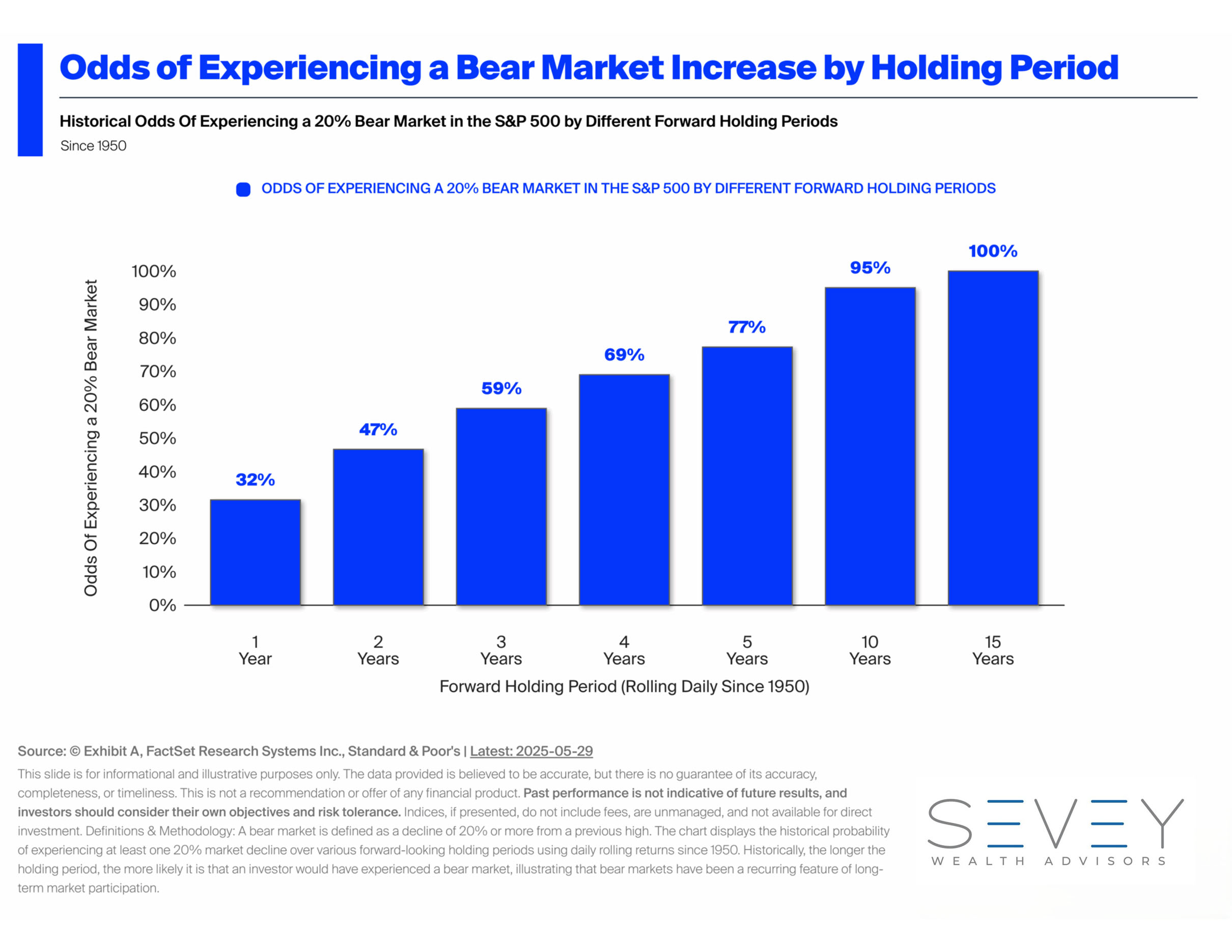

Takeaway: The longer you invest, the more certain you are to encounter multiple bear markets. Plan for several, not one.

Why Down Volatility Steals the Spotlight

We pay far more attention to volatility when prices fall than when they rise. Gains feel quiet and normal; losses feel loud and urgent. That’s human nature. Losses sting about two to three times more than equivalent gains. Add a 24/7 news cycle and flashing red tickers and it’s easy to forget the long view.

The irony is that up volatility—rallies—can be just as dramatic. We rarely complain about that. What matters isn’t whether markets swing. It’s whether your plan expects those swings and keeps you moving toward your goals.

What Actually Causes Volatility

Volatility isn’t random chaos. It’s the price constantly reacting to new information and shifting expectations. Common drivers include:

Uncertainty: Changing outlooks for growth, inflation, and interest rates.

New information: Earnings reports, labor data, policy changes, elections, and geopolitics.

Positioning and liquidity: Crowded trades, forced selling, and systematic rebalancing.

Behavior: Fear and greed cycles, herding, and momentum chasing.

None of these forces are new. They simply arrive in different combinations each cycle.

What the Data Says About Drawdowns

Many years finish positive even after scary mid-year declines. That’s easy to miss when you only see portfolio values versus the last peak. Drawdowns are part of the journey, not the end of the story.

Takeaway: Double-digit pullbacks are common, yet a large share of calendar years still end above where they began.

Common Misconceptions to Retire

“Volatility equals risk.” Real risk is failing your plan; volatility is the toll you pay to earn long-term returns.

“I can diversify it away.” Diversification smooths the ride; it doesn’t eliminate bumps.

“Cash is safest long-term.” Cash avoids price swings but invites inflation erosion.

“More time means less pain.” Time actually raises the odds you experience a bear market—but also improves the odds you recover from it.

“I’ll wait for a better entry.” Timing perfectly is a mirage. Our 12/31/1999 thought experiment shows even the worst entry can work with time, diversification, and rules you’ll stick to.

“Bonds always offset stocks.” Correlations change. Treat fixed income as ballast and income, not a guarantee.

How to Live With Volatility (Process, Not Predictions)

Right-size risk. Own a stock/bond mix you can hold through a 20–30% stock decline without flinching.

Segment cash needs. Retirees should keep 1–3 years of planned withdrawals in safe reserves so market drops don’t force bad timing.

Pre-commit your rules. Use rebalancing bands and automate contributions so you add to what’s fallen and trim what’s run.

Turn volatility into planning. Tax-loss harvest when appropriate, rebalance opportunistically, and consider using market dips for Roth conversions as part of a broader tax plan.

Build behavioral guardrails. Define in advance: “If the market falls X%, we will do Y.” That replaces panic with a checklist.

Back to 1999

Let’s return to that question: would you invest at the very top of 1999, knowing pain was coming? Most investors would say yes today because they can see the full arc of returns that followed.Your plan should give you that same confidence looking forward—so present-day uncertainty doesn’t derail long-term compounding.

We believe your portfolio should assume volatility and use it, not fear it. The goal isn’t to dodge every downdraft. The goal is to own a design you can live with, through headlines you can’t predict.

Want to see this for your situation?

We’ll model your plan using real drawdowns from the last 25 years—including the 1999 peak—so you can see how your cash, bonds, and stocks hold up. If you’re ready to replace worry with a calm, step-by-step plan, let’s run it together.