Bonds Are Starting to Act Like Bonds Again

For a while, bonds didn’t feel like bonds. Many investors expected fixed income to steady the ship, but instead saw unusual price swings and disappointing results. That disconnect created a fair question: “If bonds can drop at the same time as stocks, what are they even for?”Why the last few years felt “broken”

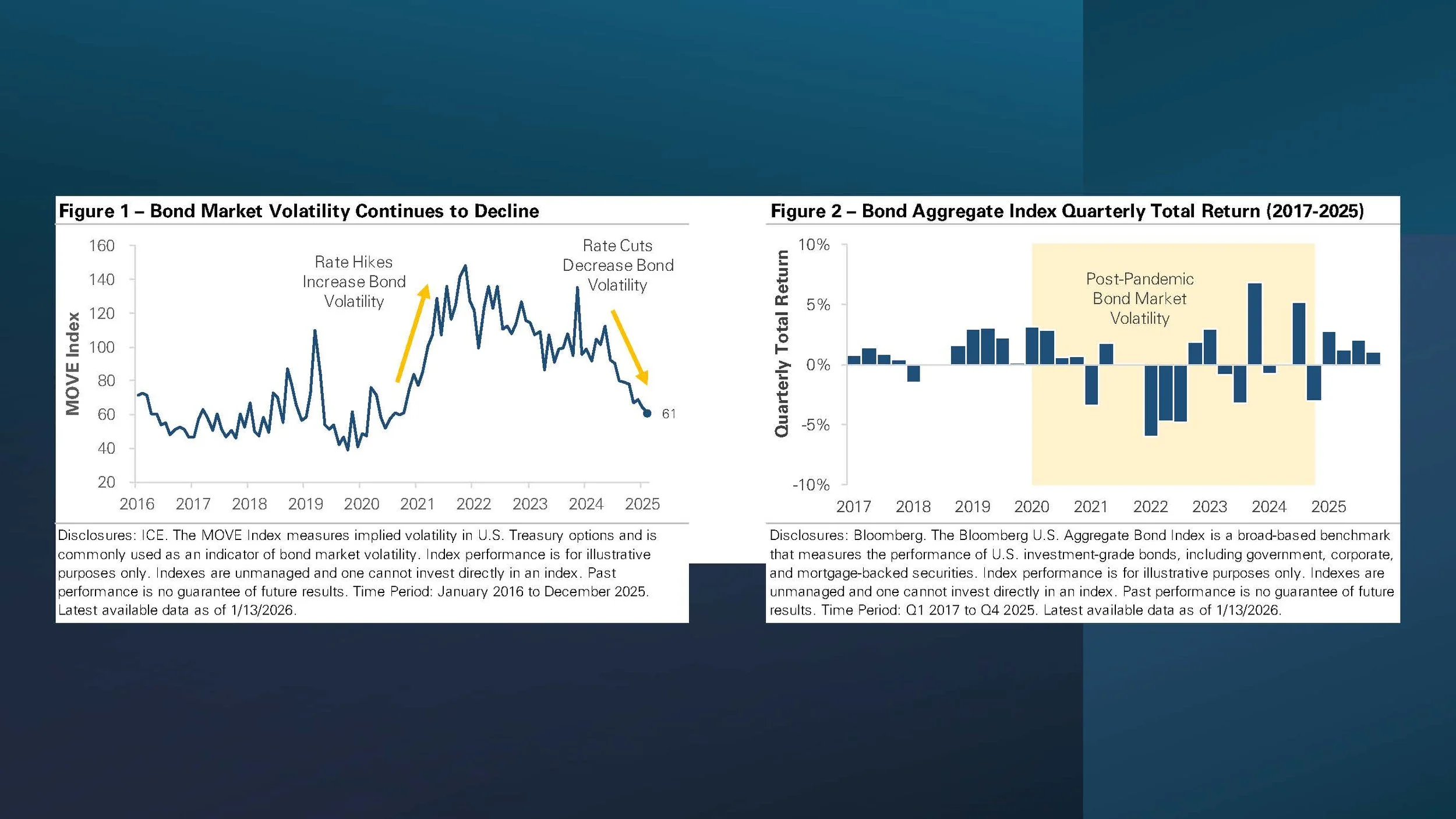

Bonds went through a rare stretch where the main driver wasn’t credit risk or the economy. It was interest rate policy moving fast, after years of rates sitting near the floor. When rates rise quickly, bond prices typically fall, and the faster the move, the more noticeable the drawdown.

That’s what made 2022 (and parts of 2023) so uncomfortable. Bonds were reacting to inflation headlines and shifting Fed expectations almost daily. In that environment, bonds can behave less like a stabilizer and more like another source of volatility.

What’s different now

Markets don’t need “perfect” conditions for bonds to play their role again. They need more normal rate dynamics and a starting yield that compensates you for taking bond risk. Recently, we’ve seen a more familiar setup:

Interest rates have been less whipsaw-driven day to day.

Starting yields are higher than they were in the late 2010s.

The conversation has shifted from “how fast will rates rise?” to “how steady will policy be?”

That combination tends to bring back the traditional bond profile: income first, and price movement second. It does not eliminate risk, but it often makes the ride feel more predictable.

What this means for your portfolio

Bonds can matter again for two simple reasons: income and balance. Income is straightforward—higher yields can support withdrawals, reduce the need to sell stocks, and improve planning reliability. Balance is more subtle—bonds can help dampen portfolio swings, especially when equity markets get choppy.

That said, “bonds” is not one decision. It’s several decisions layered together:

Duration: How sensitive should your bonds be to rate changes?

Credit quality: Are you being paid enough to take extra credit risk?

Purpose: Is this money for near-term spending, long-term ballast, or opportunistic dry powder?

Structure: How you own bonds changes your experience.

We believe fixed income works best when it’s built around a clear job. The job might be “fund the next 1–3 years of spending,” “reduce portfolio volatility,” or “create reliable income.” Different jobs require different bond choices.

If you want a second set of eyes on how you own bonds—individual bonds vs. funds vs. ETFs—and what role they’re actually playing in your plan, we can walk through it in a short review. No product sales, no pressure—just a clear, objective recommendation you can act on (or not).