Bitcoin’s Identity Crisis: Hedge, Safe Haven, or High-Volatility Trade?

Executive Summary

Bitcoin has come a long way since its early days as a volatile and experimental digital currency. Over the past decade, it has gained legitimacy, grown in market size, and attracted attention from both individual investors and large institutions. The launch of Bitcoin futures in 2017 and the approval of Bitcoin ETFs in 2024 have contributed to its maturation. Bitcoin now trades with less volatility than in its early days and behaves increasingly like traditional risk assets, such as stocks. It still carries higher volatility than other assets, but its place in financial markets has changed significantly. This report looks at Bitcoin’s evolution and what that means for its role in a well-diversified portfolio.

Five Main Points

1. Bitcoin & Gold Stand Out in a Volatile Year

Bitcoin and gold have outperformed the S&P 500 in 2025, but they’ve taken different paths. Gold’s rise has been relatively steady, gaining nearly +30% through April before leveling off in recent months. In contrast, Bitcoin has been more volatile. It fell nearly -30% in Q1 before rebounding with a +50% gain after bottoming in early April. The two assets have gained investor interest as alternative assets outperform in this year’s market volatility.

2. Bitcoin Has Grown into a Large & Recognized Market

Bitcoin’s total market value has grown from less than $10 billion in 2013 to over $2.3 trillion today, with the growth occurring in waves. Retail enthusiasm and adoption caused the price of Bitcoin to soar in 2017 before a drop of nearly -80% in 2018. A second rally began during the pandemic, when monetary and fiscal stimulus fueled a broad market rally. Bitcoin reached new highs in 2021, but prices fell again in 2022 as interest rates rose and the crypto sector faced a series of crises. The most recent rally began in late 2023, with Bitcoin surpassing $100,000 near the end of 2024. Together, the cycles track Bitcoin’s transformation into a globally recognized asset.

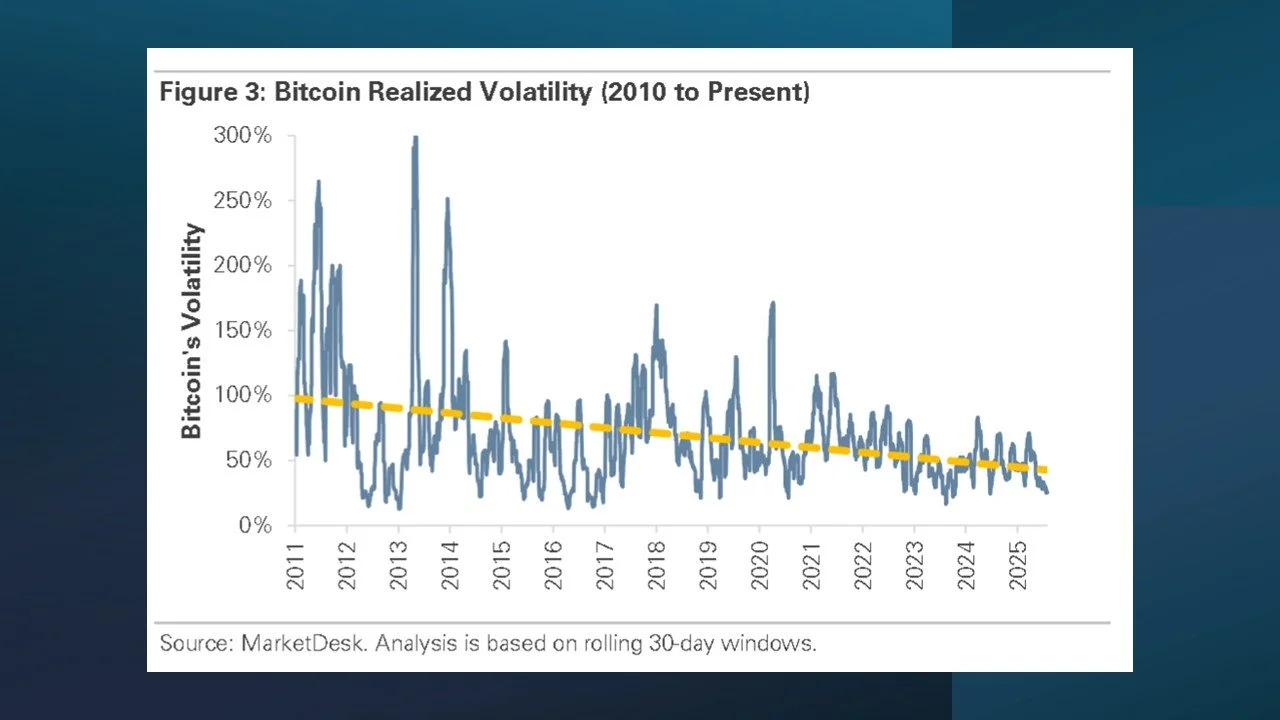

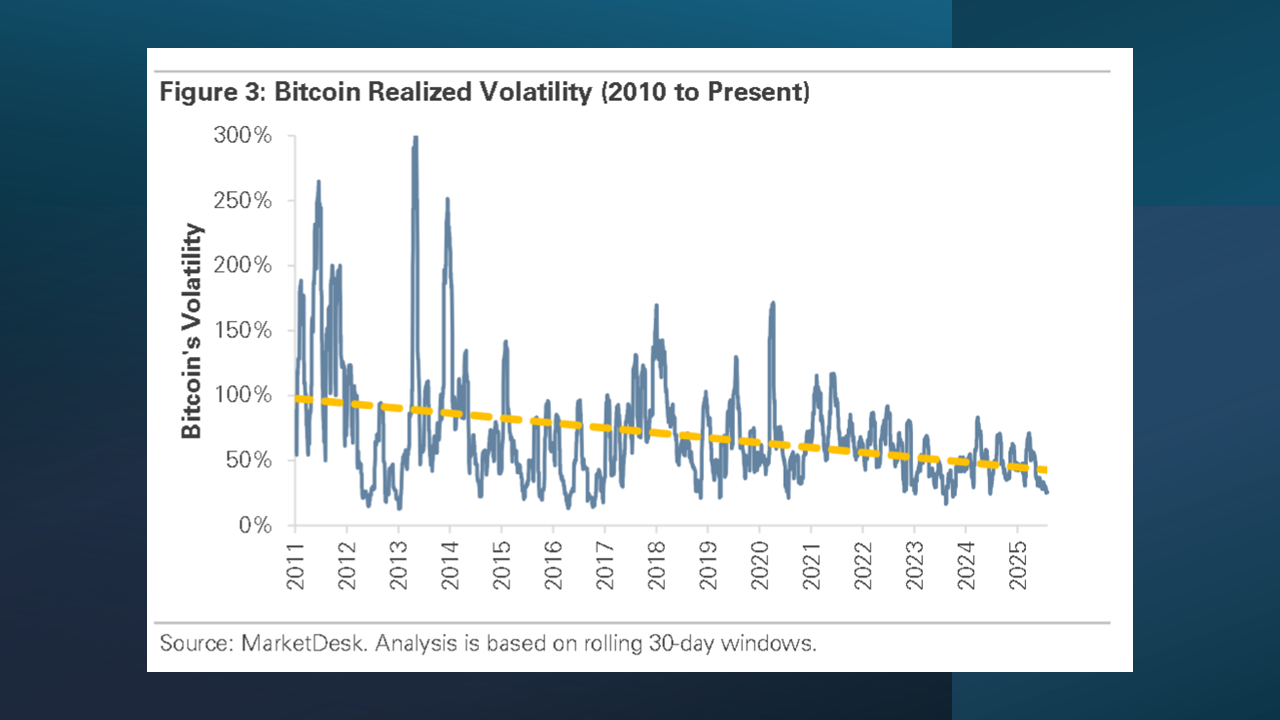

3. Volatility Has Declined But Remains High Compared to Other Assets

Bitcoin’s volatility has decreased over time due to increased institutional participation and deeper market liquidity. In its early years, Bitcoin was known for sharp price swings driven by low trading volume and speculation. The volatility has declined over the past decade, but it’s still higher than traditional assets, such as stocks. This is due to several factors, including nonstop 24/7 trading, the lack of a clear method to determine fair value, and investor behavior driven by speculation rather than fundamentals.

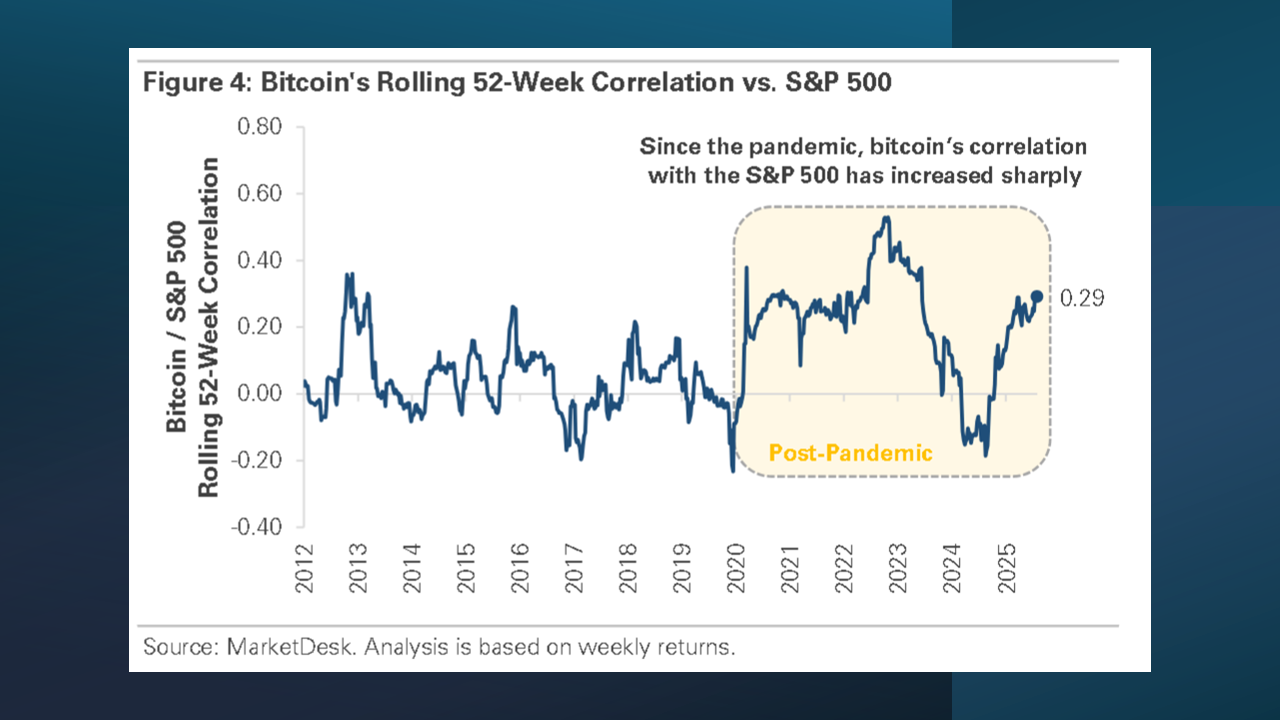

4. Bitcoin Has Become More Tied to Stock Market Movements

In its early years, Bitcoin largely moved independently from the stock market. This made it appealing to investors looking for assets that behaved differently from traditional investments. However, since the pandemic, its price has become more closely linked to the stock market. Since 2020, Bitcoin’s correlation to the S&P 500 has shifted higher, indicating it’s more impacted by factors like interest rates and investor sentiment. This shift reflects Bitcoin’s integration with the traditional financial system via ETFs, futures, and institutional trading. As a result, Bitcoin may no longer provide the diversification it once did, particularly in periods of market stress.

Bitcoin Increasingly Trades Like a Risk Asset

Gold has often acted as a safe haven during stock market declines, delivering positive or slightly negative returns. In contrast, Bitcoin has delivered mixed results. Before 2017, Bitcoin sometimes provided a hedge against stocks, with its emerging status and low correlation to traditional markets offering protection during selloffs. However, since gaining wider adoption in 2017, it’s become more likely to trade lower during selloffs. This shift from safe haven to risk asset highlights its growing connection to broader market trends and its role as a growth-oriented asset with high volatility. Investors considering Bitcoin should approach it like any other risk asset, using strategies such as regular rebalancing and setting position size based on risk tolerance.

Key Takeaways

Bitcoin has matured significantly over the past 15 years, evolving from a speculative digital currency into a globally recognized financial asset. Today, it benefits from stronger trading infrastructure, increased institutional involvement, and deeper liquidity. Its volatility has declined, and its price moves more in line with stock markets. While Bitcoin may not provide the same level of diversification as it once did, it can still play a role in growth-focused portfolios. As with any risk asset, thoughtful risk management and position sizing are important.

Important Disclosures

The information and opinions provided herein are provided as general market commentary only and are subject to change at any time without notice. This commentary may contain forward-looking statements that are subject to various risks and uncertainties. None of the events or outcomes mentioned here may come to pass, and actual results may differ materially from those expressed or implied in these statements. No mention of a particular security, index, or other instrument in this report constitutes a recommendation to buy, sell, or hold that or any other security, nor does it constitute an opinion on the suitability of any security or index. The report is strictly an informational publication and has been prepared without regard to the particular investments and circumstances of the recipient.Past performance does not guarantee or indicate future results. Any index performance mentioned is for illustrative purposes only and does not reflect any management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Index performance does not represent the actual performance that would be achieved by investing in a fund.