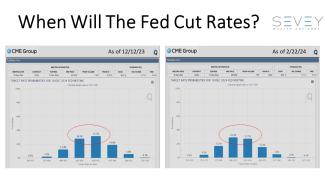

When Will The Fed Cut Rates?

Two months into the new year, people are keeping a close eye on the Federal Reserve and what they plan to do with interest rates.

Some investors are excited about the possibility of the Fed lowering rates. But now, it seems like they might wait until later in the year to do it. The forecast is suggesting there might be one cut by June and maybe more later on.

The Fed is in a tough spot because the economy is doing pretty well. They don't want to make a mistake by cutting rates too early and then having to change their minds and raise rates again. The Fed's main job is to make sure there are enough jobs for people to work (Maximum Employment) and to keep prices stable (Price Stability or Inflation).

The Fed is watching out for two main things:

1. **Inflation:** The Fed is okay with how prices have been going for the past six months, but they want to be sure it stays that way. They don't want prices to go too high or stay above their target.

2. **Employment:** There are plenty of jobs available right now, but the Fed is a little worried because it looks like the number of new jobs might be slowing down. It's not slowing down enough to cause a big problem, but they're keeping an eye on it.

For people who invest in stocks, it's a good idea to be patient. The Fed will probably lower rates, but it might not happen as quickly as some people hope. For those who invest in bonds, this might be the last chance for a while to get good returns before they start going down. It's like having the chance to take a better road before it's too late.

Wondering how this will impact your portfolio? At Sevey Wealth, we have a strategy for this... do you?