The S&P 500 recently hit 5000. What does it mean and where are we headed?

The S&P 500 took over headlines this month when it closed above 5,000 points for the first time. For many clients, these thresholds can cause anxiety for clients. In this article, we're looking back at how the S&P 500 got here, and what could happen next.

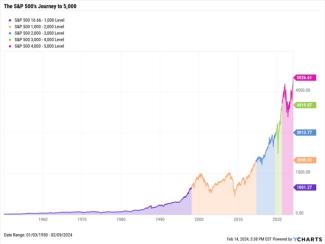

From humble beginnings at just 16.66 points in January 1950, the widely followed benchmark index has traveled far in the almost 75 years since, generating incredible wealth along the way.

We’ll explore the S&P 500’s journey to each 1,000-point milestone, lessons about volatility learned on the path to each level, and answer the question: How can advisors prepare their clients for ups and downs on the road to 6,000 and beyond?

Where is the Market Right Now?

The S&P 500 closed above 5,000 for the first time on February 9th, 2023, at 5,026.61. The index’s journey from 16.66 to 5,000 elapsed 74 years, 1 month, and 7 calendar days.

Each horizontal red line marks a 1,000-point increment, while vertical gray bars indicate a recession period.

S&P 500 Level Date First Reached (Market Close) Time to Reach Milestone

1,000 2/2/1998 48 years, 1 month, 0 days

2,000 8/26/2014 16 years, 6 months, 25 days

3,000 7/12/2019 4 years, 10 months, 17 days

4,000 4/1/2021 1 year, 8 months, 21 days

5,000 2/9/2024 2 years, 10 months, 9 days

Early Innings: The S&P’s Rise to 1,000

It took the S&P 500 index nearly half a century to reach 1,000 points. Starting at 16.66 on the first trading day of 1950, the S&P 500 closed above the 1,000-point milestone for the first time 48 years and 1 month later.

Though the chart above might show a fairly smooth rise to 1,000, including accelerated growth starting in the 1980s, there were several major bumps along the way. In that 48-year journey, there were seven drawdowns of 20% or more, with the largest being 48.2% in October 1974. Eight recessions also took place.

What Happened After the S&P 500 Reached 1,000?

The S&P 500 went from 1,000 to 2,000 in 16 years, 6 months, and 25 days, closing at 2,000.02 on August 26th, 2014. The index achieved its second 1,000-point milestone in about ⅓ of the time as the first.

The S&P 500 endured two of the largest recessions in history: the Dot-Com Bubble and the Great Financial Crisis. Both events also produced two of the largest drawdowns in history. On the journey to 2,000, it took the index two years to get halfway…but the rally stalled out, and the index bumped against 1,500 again in 2007.

What Happened After the S&P 500 Reached 2,000?

After closing above 2,000 for the first time, the S&P 500 advanced to 3,000 in 4 years, 10 months, and 17 days. It closed above 3,000 on July 12th, 2019. Similar to its journey from 1,000 to 2,000, the index rose from 2,000 to 3,000 in exponentially less time.

There were neither any recessions nor any bear markets (generally defined as drawdowns of 20% or more) in this five-year span. The largest drawdown during this period was 19.8% in December of 2018, along with two other drawdowns of at least 10%.

What Happened After the S&P 500 Reached 3,000?

The S&P 500’s run from 3,000 to 4,000 took the shortest amount of time. The index climbed another 1,000 points in just 1 year, 8 months, and 21 days, reaching 4,000 on April 1st, 2021. Despite the event occurring on April Fools Day, such a fast 1,000-point advance was no joke.

However, even 1,000-point jumps as fast as this one aren’t immune from major drawdowns. The Covid-19 pandemic in early 2020 sent the S&P 500 down almost 34% in a matter of weeks. Fortunately for long term investors, the index roared all the way back, setting a new all-time high five months later on August 18th, 2020.

What Happened After the S&P 500 Reached 4,000?

That brings us to today. The S&P 500 traveled from 4,000 to 5,000 in 2 years, 10 months, 9 days. Though it took about twice as long as the journey from 3,000 to 4,000, this fifth 1,000-point advance was the index’s second-fastest.

On the road to 5,000, market participants endured a prolonged drawdown first. The S&P 500 entered this decline after January 3rd, 2022, sank to a max drawdown of 25.4% on October 12th, 2022, and didn’t set a new all-time high for a little over two years until January 19th, 2024. Three weeks later, the index crossed the 5,000 mark.

What Could Happen Next for the S&P 500?

As the S&P 500 progresses to the next level of 6,000, it’s important to note that the journey to each milestone was marked by periods of volatility. Most 1,000-point marks included drawdowns of over 20%.

At the same time, the amount of time it has taken to achieve new 1,000-point thresholds has gotten shorter in duration. Though there are no guarantees on whether it will take the S&P 500 1 year, 10 years, or 100 years to reach 6,000, advisors can inform their clients that the best way to ensure they are part of the next milestone celebration is time in the market rather than timing the market.